- Reducing Remittance Fees: Successfully reduced remittance fees beyond the United Nations Sustainable Development Goal of 3% by 2030, making international money transfers more affordable for millions of users.

- Multi-National Banking Integration: Connected banking systems across multiple nations, each with different protocols, regulations, and technical infrastructures. This required deep understanding of international banking standards and payment rails.

- Complex Compliance Requirements: Navigated the intricate landscape of anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, and financial compliance across different jurisdictions.

- Scalable Multi-Tenant Architecture: Designed a system that could support multiple financial institutions as partners while maintaining data isolation and security.

TransferLink

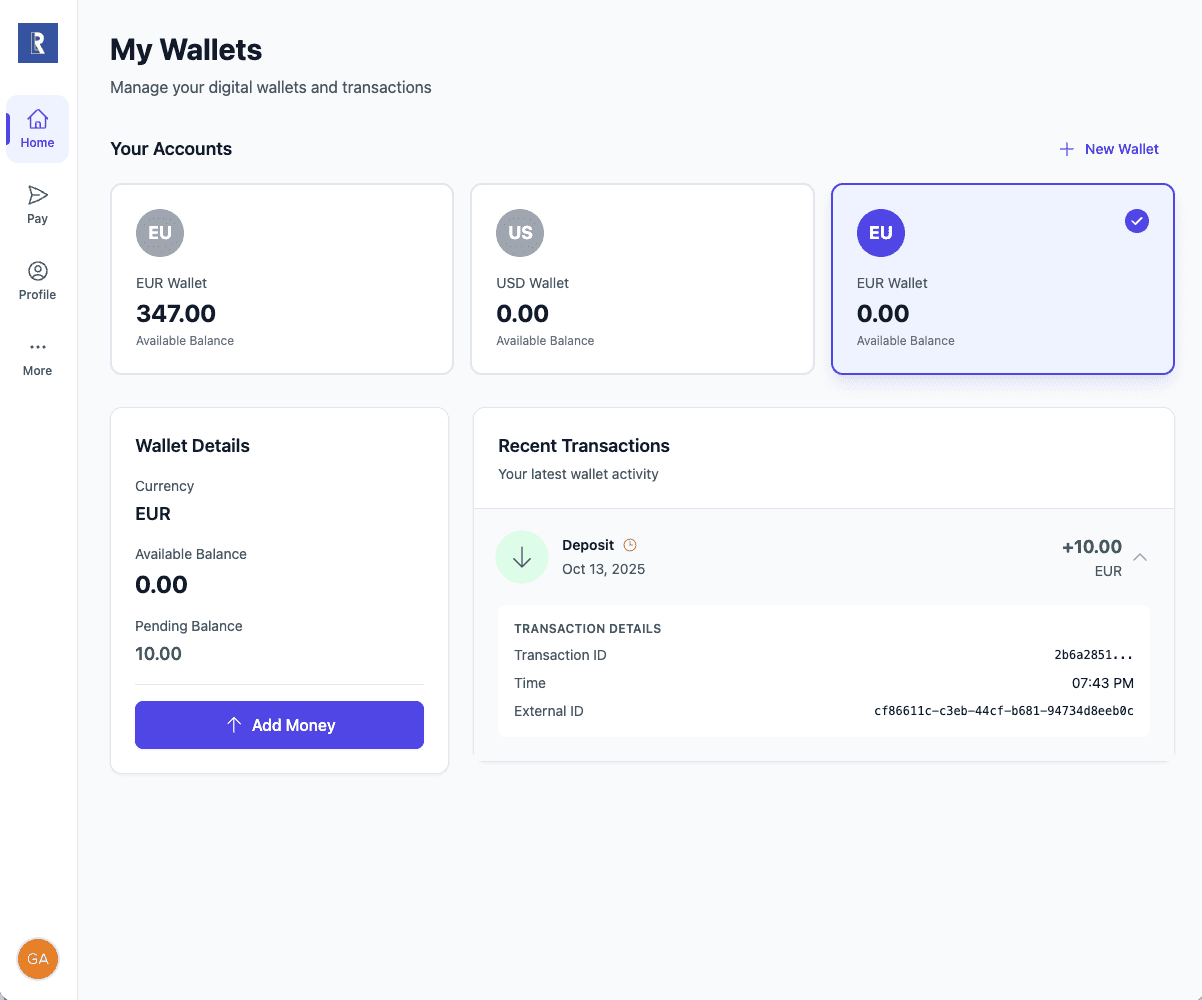

Network-Based Remittance Platform

TransferLink represents a new way of doing remittance. Instead of relying on a single provider, it uses a network of financial institutions that are properly connected and own part of the system. This collaborative approach reduces costs and increases accessibility for users worldwide.

As Head of Technology, I played a crucial role in understanding the different national requirements in terms of money laundering, banking systems, e-wallet solutions, and other mechanisms. The goal was to offer all the options to the end customer without forgetting compliance, and adjusting the technology to real-world needs.

Challenges Solved

Technical Approach

The platform is built using Domain-Driven Design principles, which proved essential for modeling the complex business rules and regulations of international remittance. This approach allowed us to create a shared language between technical and business teams, crucial when dealing with compliance and financial operations.

Kubernetes orchestration on Google Cloud Platform provides the scalability and reliability needed for financial transactions. The microservices architecture, built with NestJS, allows different components to be updated and scaled independently.

PostgreSQL serves as the primary database, chosen for its ACID compliance and robust transaction support—critical requirements for financial applications. The database design ensures data consistency across distributed transactions.

Outcomes

- Below UN Goal Fees: Achieved remittance fees below the United Nations Sustainable Development Goal, making international transfers more accessible to underserved communities.

- Multi-Country Coverage: Successfully connected banking systems across multiple countries, creating a truly international remittance network.

- Compliant Platform: Built a platform that meets regulatory requirements across all operating jurisdictions, with robust AML and KYC processes.

- Partner Network: Created a collaborative ecosystem where financial institutions can participate as partners, sharing in the platform's success.

- 7-Year Evolution: Maintained and evolved the platform over 7 years, demonstrating sustainable architecture and technical leadership.